Emails offering fast and easy MCA loans are as common as the struggling small businesses they target. These offers promise quick funding—seemingly attractive opportunities for business owners in need of immediate financial assistance. However, the reality behind these merchant cash advance (MCA) loans is not always as straightforward as the initial propositions make them out to be. The seemingly simple terms and conditions that come with MCA financing can hide a multitude of costs. Knowing the tricks and gotchas these lenders use could be the difference between success and bankruptcy.

If you’re considering a merchant cash advance loan, you must understand the lurking costs involved before making a decision. You can also learn how you can refinance your business debt. In this blog, we’ll dive deep into the complexities of MCA loans and how to calculate their true interest, so you’re equipped with the knowledge to make informed choices.

Deciphering MCA Loan Offers

The allure of fast and easy small business loans often blinds entrepreneurs to the complexity of the terms they’re agreeing to. To illustrate this, we’ll compare two real loan offers to uncover the hidden costs and nuances that can make a world of difference in your financial decisions.

Analyzing Small Business Loan Terms

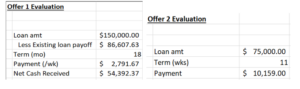

MCA loans are designed with an intricate structure to confuse borrowers. Our client was presented with these two offers: a $150,000 loan to pay off an existing $86,000 loan over 18 months, requiring a weekly payment of $2,700; and a separate $75,000 loan to be paid off over 11 weeks with a $10,000 weekly payment.

You might already be cross-eyed by all those numbers. That’s intentional: MCA lenders prey on overworked entrepreneurs who have neither the time nor patience to think through details. Rather than rush through a decision, you should contact your financial advisor to assist with analysis.

Let’s start by organizing the figures into a format that is easier to understand.

Upon initial inspection, the offers may seem beneficial, especially with the promise of funding the loan in 24 hours (compared to banks that need 4 weeks to close loans.) However, analyzing the true cost of this capital is crucial to not getting ripped off. MCA lending loans are intentionally structured to be confusing, making it difficult for borrowers to accurately assess the overall expenses and determine the best deal for their business. To calculate the cost of capital, we need to unwind all these translations into two figures: the total loan repayment and the interval of time.

Unveiling the True Cost of Capital with Total Loan Repayment

Behind the business loan interest rate lie additional fees and confusing terms that elevate the actual cost of the loan. For example, the loan term is stated in months, but repayments are made in weeks. When calculating total loan repayment, a common miscalculation arises from assuming an average of four weeks per month, when in reality, there are 4.2 weeks per month (52 weeks / 12 months.) This error can significantly understate the total amount to be repaid.

Considering the $150,000 loan example, a simple interest calculation based on the given data might initially suggest a 34% interest rate. However, upon closer scrutiny, it becomes apparent that the net cash received plus the loan used to pay off the existing debt amounts to $141,000, revealing a $9,000 discrepancy—implied loan fees that are not explicitly stated. Taking these fees and interest into account, the effective cost of capital increases by an additional 9%, leading to a revised APR of 43%.

Annualizing the MCA Loan and Uncovering Tricks

The devil is in the details when it comes to understanding the annual percentage rate (APR) equivalent of MCA loans. The confusing tactics can significantly inflate the APR, altering your perception of the true cost of the loan. For example, on first examination, the $75,000 loan appears to have 49% interest ($111k repaid vs. the $75k loan). But when evaluated using time-weighted interest, the APR equivalent turns out to be nearly 3,000%.

By shedding light on these intricate aspects, business owners will be better equipped to navigate the complexities of annualizing MCA financing and identify potential pitfalls in loan offers.

Conclusion

These examples demonstrate how MCA loans involve complex cost structures, mixing fees with interest, pushing borrowers into exorbitant interest rates, and intentionally creating confusion in loan terms and conditions. For individuals considering such financial options, it’s essential to seek guidance from financial professionals, such as fractional CFOs, to accurately assess the true cost and ramifications of these loans.

For professional help managing your MCA loans, schedule a call with our team to get back on top of your debt.

This article was written by a CFOshare employee with assistance from generative AI for rhetoric, grammar, and editing. The ideas presented are a combination of the author’s expertise, original ideas, and industry best practices.