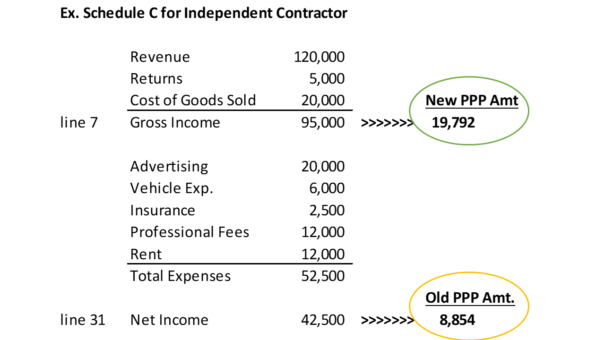

If you are a sole proprietor, independent contractor, or single-owner LLC, you have a lot more PPP money coming your way. Yesterday the SBA released new guidance to increase PPP owners compensation for sole proprietor businesses. By changing the definition from Net Profit to Gross Income, sole proprietors can re-apply and get more PPP money.

The definition of owners’ compensation for PPP

The PPP is designed to save jobs and wages. But owners of sole proprietor businesses (including independent contractors) do not pay themselves W-2 employee wages. Instead, they get passthrough income, referred to by the PPP program as owner’s compensation.

Previously the SBA defined an owner’s compensation as IRS form 1040 Schedule C line 31 Net Income. This number represents profit after deducting all costs and expenses. The definition penalized business owners for fixed expenses, like overhead, as well as startup businesses that did not turn a profit in 2019.

The new SBA guidance defines owner’s compensation as Schedule C line 7 Gross Income. Gross Income is all revenues less discounts, returns, and material cost of goods sold. (Something close to GAAP gross profit, although not exactly.) Gross Income is always higher than Net Profit (or at least the same.) By using this figure, most business owners will now have significantly higher owner’s compensation and thus PPP loan amounts.

Note that owner’s compensation is still limited to $100k/yr. when calculating PPP loan amounts.

Who benefits from the change in owner’s compensation definition?

The following is a list of sole proprietor businesses or independent contractors who may benefit from the change in rules:

- Startups with little or no profit in 2019

- Businesses with large fixed expenses

- Businesses that used 1099 contractors rather than employees in 2019

- Businesses that had no employees in 2019

The following businesses will not benefit from the change in owner’s compensation rules:

- S-corp or C-corp entities

- Partnerships filing form 1065

- Businesses with Schedule C line 31 Net Income in excess of $100k in 2019

- Businesses with zero revenue in 2019

Increased audit risk for using Gross Income

Using these new rules may create audit down the road. In order to avoid fraud and abuse, the SBA is revoking their “necessity” safe harbor rules for anyone borrowing more than $150k using the new owner’s compensation definition. As a reminder, when applying for the PPP you must certify that the “economic uncertainty… makes this loan necessary…” Up until now, the SBA assumed any loan under $2M would automatically qualify as necessary. Now, that threshold will be lower if you are a sole proprietor using Schedule C line 7 to calculate your loan amount.

If you don’t want to take this audit risk, you can still use the old calculation (line 31 Net Income) to play it safe.

Take advantage of changes in PPP owner’s compensation rules

If your business already received a PPP loan but now qualifies for more funding due to the change in rules, you can re-apply for an increase through your original lender. But you should act quickly – certain events prohibit you from re-applying, such as if your loan is sold or if you begin repaying the PPP. The rules are complex, so contact your lender to find out if you are eligible.