A pro forma balance sheet is a key component in your pro forma, your 5- to 7-year projection. It lists out your future assets, liabilities, and stockholders’ equity in the same format as your historical balance sheet.

What is the purpose of a pro forma balance sheet?

As a startup founder, you can use pro forma balance sheets to manage and plan for your future assets. Pro forma projections ensure that there are no surprises as you manage your liabilities and additional assets, like inventories. A potential investor in a start-up is going to analyze pro forma balance sheets to calculate their potential return on their investment.

As a manager for an established business, a pro forma and its statements help you make internal decisions. Let’s say your company is looking to invest in 1 of 3 different machines to produce your final product. Creating a pro forma and including the balance sheet allows you to make side-by-side comparisons of those machines over time and make a strategic decision from that comparison.

You can create a business pro forma on your own to better learn your numbers. Once you have made the attempt but feel it could be more complete, pro forma services are provided by skilled financial analysts, like those at CFOshare. Pro forma projections paint an accurate and complete picture of your company over the next 5–7 years in a clear and neat format

What is the difference between a pro forma balance sheet and a balance sheet?

The only difference: the timeframe.

A traditional balance sheet is historical, a tabulation of what has already occurred. Pro forma balance sheets, like pro forma, are future-looking, often 5 years into the future. As a startup founder, your goal is to plan for your business pro forma rather than review what historically took place.

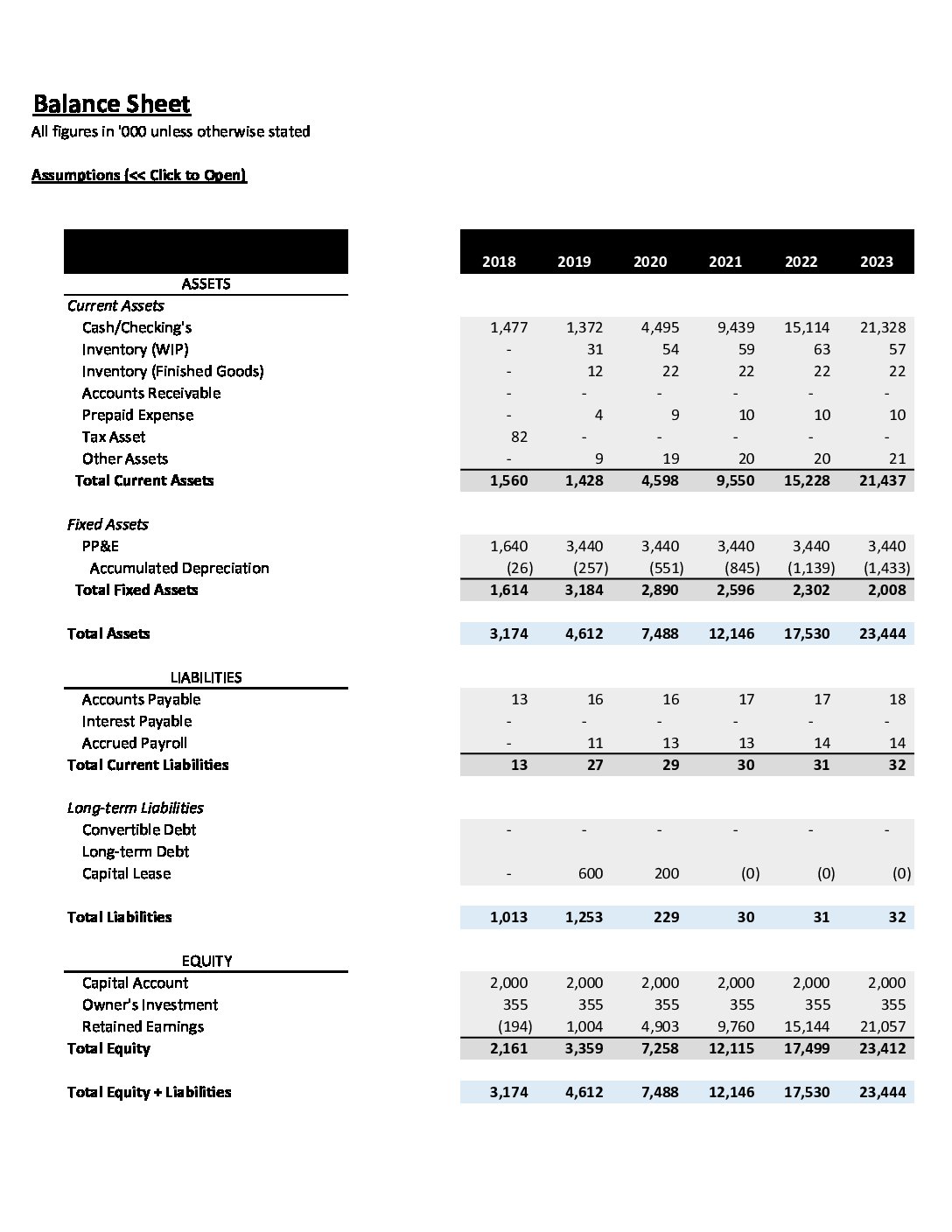

Here is an example of a pro forma balance sheet:

You can see that it is projecting into the future. Try googling Amazon’s balance sheet. You will notice that it is organized by months that have already occurred.

Why is a pro forma balance sheet important?

Let’s say your new business is going to produce consumer goods. In year 3 of producing your goods, you know you want to buy a warehouse for your inventory. Your 5-year balance sheet will help to forecast if that expense can be bought with cash or if it will need financing.

This highly specialized form of forecasting helps you, as a key decision-maker, determine which options are profitable or even viable.

What are pro forma financial statements?

Pro forma financial statements include the same statements as those of an established business. They should include at least a balance sheet, a profit and loss statement, and a statement of cash flows. Those statements convey the future business activities and the future financial performance of the company.

If you don’t have a finance background or know nothing about forecasting, you may simply waste your time trying to build your own pro forma financials. That’s when hiring a professional, like those at CFOshare, is the fastest and most cost-effective approach.