To most small business owners, accounting best practices feel like an annoyance and distraction. However, common mistakes can create an accounting mess and impede growth. Rather than discovering these mistakes through frustrating setbacks, use this blog to identify your pitfalls and how to steer clear of them, helping you maintain a robust growth trajectory.

Delayed Month Close: The Pitfall of Outdated Information

Mistake: Allowing late publication of monthly financial statements.

Impact: Late financials are outdated news—stale data that slows decision-making. Lacking timely financial data, managers act on instinct rather than data, leading to costly mistakes and an undisciplined team culture.

Solution: Accounting best practices require financials to close by the 15th each month. Identify roadblocks holding back your bookkeeper, like late expense reports, and challenge your team to execute a disciplined playbook to keep the books accurate and timely.

Poor Cost Accounting: The Misleading Numbers Game

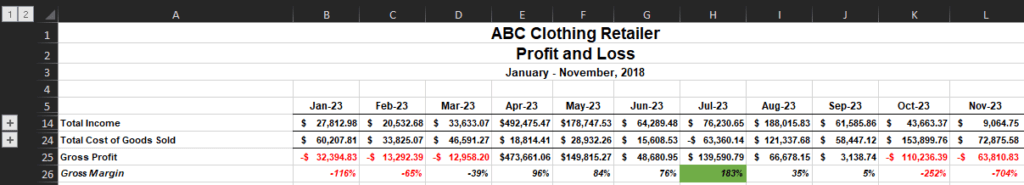

Mistake: Ignoring your cost accounting. Cost accounting ensures your costs are timed correctly and gross profits are accurate. Common costing mistakes include:

- Lumping all payroll into one bucket called “wages”

- Failure to use an employee time-tracking system

- Only including direct material costs into COGS

- Failing to accrue work-in-process and inventory correctly

Impact: Inaccurate cost allocations can inflate gross margins. Have you found yourself surprised at net losses despite bringing on new, highly profitable customers? Bad costing fosters a business that is unprofitable at any level of revenue, surprising and frustrating owners.

Solution: Develop an accurate cost accounting process with a knowledgeable accountant and consider a cost accounting clean up. This will give you a clearer picture of your profitability and guide better business decisions.

Cash Basis Financials: The Limitations of Intuition

Mistake: Reporting financials on a cash basis, especially as your business grows beyond $3 million in revenue.

Impact: Cash basis financials ignore timing differences, causing management to make adjustments to the numbers in their heads. That is feasible at a small level, but impractical beyond $3M revenue.

Solution: Transition to accrual accounting to gain a more accurate picture of your financial health. Be sure to an expert experienced in cash-to-accrual conversions to perform the accounting clean up.

Ignoring the Balance Sheet: Missing the Full Picture

Mistake: Focusing only on revenue and profit while neglecting your balance sheet.

Impact: Ignoring your balance sheet can set you up for cash flow surprises and unforeseen losses.

Solution: Regularly review your balance sheet. Pay close attention to accounts with lurking surprises, like:

- Accounts receivable

- Deferred revenue

- Inventory

- Work in process

Accounting best practices include analyzing large month-over-month movements, negative balances, and accumulating balances to identify potential business concerns.

Lazy Collections: The Cash Flow Bottleneck

Mistake: Informal collections procedure

Impact: Inefficient collections lead to cash flow issues and lost revenue.

Solution: Establish a disciplined, proactive weekly collection process. This includes setting up an escalation procedure and ensuring routine execution, possibly by your admin or bookkeeper.

Empower Your Growth with Proactive Accounting

Effective accounting practices are not just about compliance; they are about executing a disciplined business and making strategic decisions based on accurate and timely financial data. If you’re facing challenges in these areas, it might be time to revamp your finances with an accounting clean-up.

If your business is ready for a professional accounting approach, contact us for a free consultation on an accounting clean up.

This article was written by a CFOshare employee with assistance from generative AI for rhetoric, grammar, and editing. The ideas presented are a combination of the author’s expertise, original ideas, and industry best practices.