Small Business

The Key Differences Between a Controller and a CFO in Small Businesses

July 16, 2024

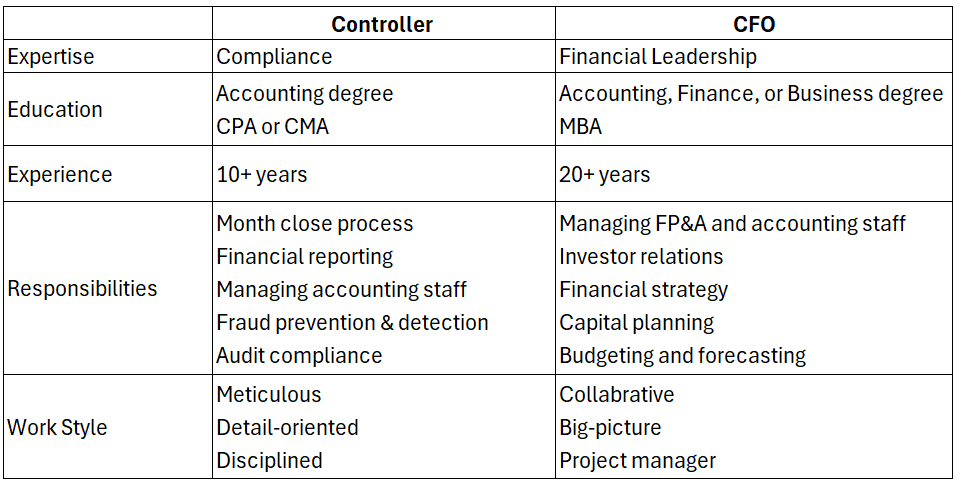

When building your back office, you may consider whether you need a financial controller or a CFO. The skills and responsibilities of these roles overlap, and to make matters more confusing, an underqualified CFO (yes, there are plenty out there) will perform similar to or worse than an excellent controller.

Whether you are hiring full-time or fractional, knowing how these roles differ between a controller vs CFO will ensure your small business gets the financial support it needs without overspending.

How Does the Role of a CFO Differ from That of a Controller?

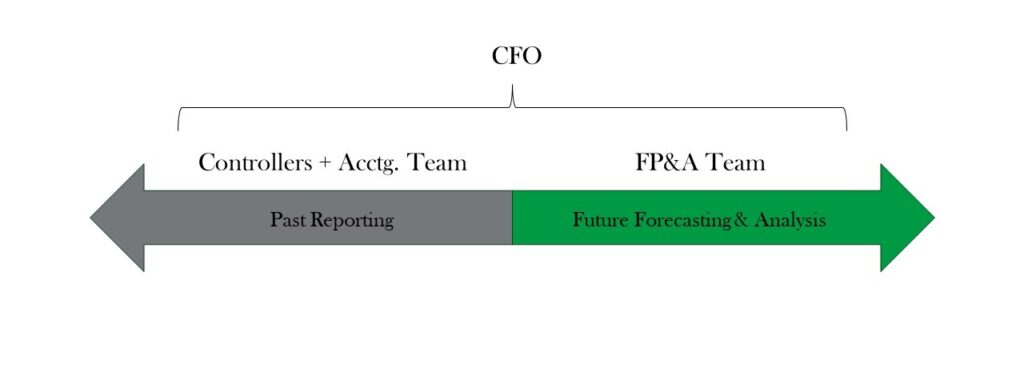

The primary difference between a controller vs CFO lies in their scope of responsibility and focus areas. A controller primarily oversees accounting processes, ensuring accurate financial records and compliance with regulations. In contrast, a CFO is a more strategic financial professional, focusing on long-term planning, investor relations, and overarching financial strategy.

Purpose of the Role

The controller ensures financial reporting compliance and accuracy while preventing and detecting fraud.

The CFO is a strategic financial leader of the organization. They collaborate with executives, investors, and the finance team to manage risk, choose investments, and collaborate on strategic decisions.

Education and Experience

Controllers typically have an accounting degree supplemented with an optional CPA or CMA and 10+ years of experience in managerial accounting.

CFOs, being a less technical role, rely less on their education and more on their 20+ years experience managing business financials. CFOs, being a high-profile role, lean more on their reputation than credentials but may have an MBA, CPA, CFA, or CFM.

Responsibilities

A controller ensures accurate record-keeping and compliance with financial regulations. They are accountable for the precision of financial reports, which typically involve:

Managing staff accountants and bookkeepers

Monthly financial reporting

Fraud prevention and detection

Audit process management and compliance

A CFO’s responsibilities take on a broader scope, including making high-level financial decisions, guiding financial strategy, and overseeing the company’s financial actions. This typically includes:

Providing Management Discussion and Analysis (MD&A) on financial statements

Planning and executing capital strategy

Interpreting forecasts and guiding executives and investors

Working with other departments to manage financial risk

Managing all company financial professionals, including controllers

Maintaining investor relations

Work Style

A controller is meticulous and detail-oriented. They focus on data accuracy and regulatory compliance, rely on regimented processes, and are generally wary of change.

A CFO is innovative, high-level, and less detail-oriented. They are highly collaborative and often work with other departments to align financial strategies with overall business goals. CFOs must also be excellent communicators.

Summary of differences between a controller vs CFO

What Are the Key Responsibilities of a CFO?

For small businesses employing a fractional CFO, understanding the core responsibilities of a CFO can help leverage their expertise effectively.

Strategic Planning and Forecasting

CFOs create long-term financial plans and forecasts. They analyze market trends and economic data to predict future financial performance and guide strategic decision-making.

Investor Relations

CFOs manage relationships with investors to ensure sufficient capital support for the business. They foster trust and secure funding by communicating the company’s financial health, investment opportunities, and risks.

Financial Decision-Making

CFOs oversee major financial decisions, including budgeting, investments, and capital allocation. They ensure these decisions align with the company’s strategic objectives and financial goals.

Finance Department Management

The CFO is responsible for directly or indirectly managing all financial professionals in the company, including accountants, analysts, FP&A professionals, and controllers.

Collaboration with Other Departments

CFOs work closely with other senior executives to integrate financial insights into broader business strategies. They ensure that financial considerations are part of the decision-making process across the organization.

Fundraising

CFOs play a crucial role in raising capital through equity or debt financing. They develop and present financial narratives that attract investors and secure the necessary funding for growth.

What Are the Key Responsibilities of a Controller?

Controllers handle the operational side of financial management, ensuring that the day-to-day accounting functions are carried out accurately and efficiently.

Financial Record-Keeping

Controllers maintain the company’s financial records, ensuring the accurate recording of every transaction, including general ledgers, accounts payable/receivable, and payroll.

Compliance and Reporting

Controllers ensure the company complies with all financial regulations and standards. They prepare financial reports and statements that clearly and accurately represent the company’s financial position.

Internal Controls

Controllers implement and oversee internal controls to prevent fraud and ensure the accuracy of financial data. They regularly audit processes to maintain the integrity of financial operations.

Why Small Businesses Might Need a CFO and Controller

In small businesses, the roles of a fractional controller vs CFO complement each other. A fractional controller ensures daily financial operations run smoothly, while a fractional CFO can provide strategic oversight. This combination allows small businesses to maintain accurate financial records and make informed strategic decisions, all for less than the cost of a full-time finance executive.

By understanding these roles and their responsibilities, small business owners can better structure their financial teams, leveraging the strengths of both controllers and CFOs to achieve their business objectives.

Related Articles

Ready to Elevate Your Finances?

Need more specific advice? Schedule a consultation