A cap table is a table that shows the equity ownership capitalization for a company. It details who owns what, delineating the percentages of ownership, equity dilution, and equity value among the company’s shareholders. This includes all types of equity ownership: common shares, preferred shares, options, warrants, etc.

Why is a Cap Table Important?

A cap table is boring but crucial – its importance cannot be understated, especially as it pertains to the accuracy of ownership percentages. Even a minor miscalculation during a sale or other liquidity event can lead to significant financial discrepancies, risking not just relationships with investors but potentially derailing the sale of a business.

Imagine yourself years from now, poised to sell your company for $25 million. As part of the transaction’s closing requirements, you must provide the final capitalization details to the buyers. It’s at this juncture they discover a critical error: an investor was verbally told they owned 20% of the company, but after accounting for dilution from options and convertible notes, their actual stake is only 16%. This 4% discrepancy is worth $1 million for that investor.

Faced with this unexpected shortfall, the investor disputes the figure, threatening legal action if you don’t honor the full 20%. When the buyers catch wind of the threat of litigation, they get nervous and postpone the deal. Two months of negotiation and uncertainty later, the buyers withdraw from the transaction entirely. The entire $25M deal collapsed because investors and management did not have clear agreement on ownership %.

Every year hundreds of small businesses face similar conundrums. This story underscores the risk of miscalculating ownership stakes and the potentially disastrous consequences of such errors. A reliable cap table management system could have averted this scenario by providing clear, accurate, and up-to-date ownership data to all parties involved years before the M&A event.

Why Calculating Capitalization Is Difficult

Cap tables can quickly become complex as a company grows. Initial straightforward ownership splits dilute different amounts through:

- new rounds of funding,

- the issuance of employee stock options, and

- the issuance of convertible notes and warrants.

Each of these events can dilute original ownership percentages, making the precise tracking of these changes not just beneficial but necessary for a company’s leadership and its investors. Most small businesses ask their fractional CFOs or attorneys to manage their cap tables to manage this complexity.

Cap Table Management = Necessary Expense

Small partnerships may balk at the expense of cap table software, but jeopardizing the sale of your business is an even larger risk. The right cap table management solution, properly managed by a fractional CFO or attorney, can save a company not only from financial discrepancies but also from the kind of investor mistrust and transactional disruptions that can halt its growth, or worse, lead to its downfall. Here are five essential tips to consider when hiring a fractional CFO for your business:

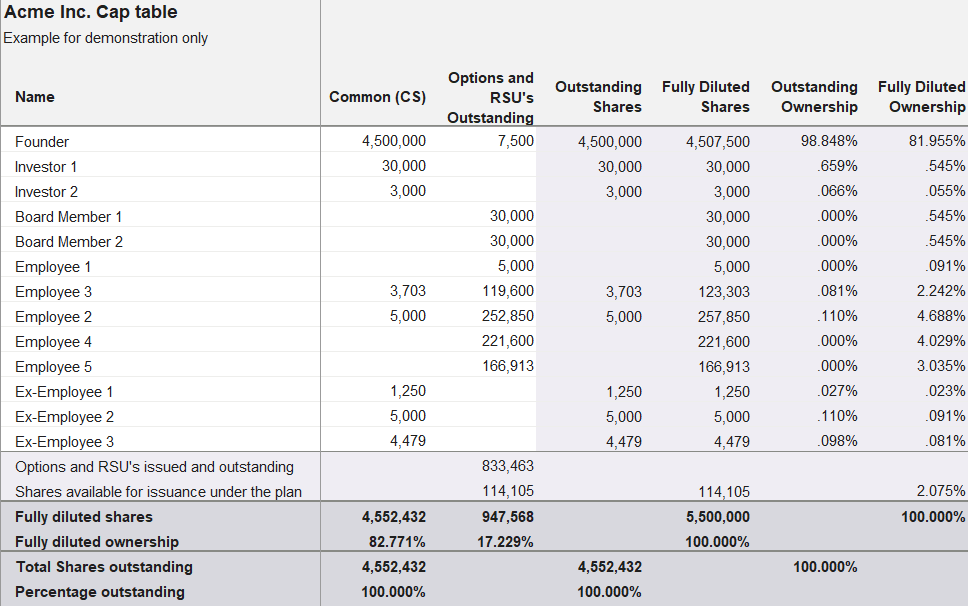

How To Read A Cap Table

Your cap table should list every investor, by investment class, on the left-most column. This includes:

- initial equity allocations,

- all subsequent investment rounds,

- grants of stock options, and

- any other changes in equity ownership.

The total undiluted and diluted shares for each investor should be listed in two separate columns. Ownership % may be calculated on a cap table but is not required.

A well-maintained cap table provides a clear picture of who owns what at any given time, ensuring that all shareholders understand their current positions and how future transactions might affect their ownership percentages.

Clean Cap Table = Clean Exit

Understanding and maintaining an accurate cap table is not merely an administrative task; it’s a foundational aspect of investor relations. It ensures clarity, fairness, and trust among all parties involved, providing a solid basis for decision-making and future growth. For small business owners navigating the complexities of partnership and investment, investing in cap table management is not just prudent; it’s essential for safeguarding the company’s integrity and its financial future.

Do you want to trust this critical task to professionals? Consider hiring a fractional CFO to ensure your cap table is setup correctly.