Every day in the news you can read about inflation fears: supply shortages, price increases, stock prices tumbling… And while big papers talk about the NASDAQ and CPI, the question that’s more interesting to me as a fractional CFO is: what does inflation mean for small businesses? In this article, we will explore the cause of inflation, its effects on small businesses, and what you as a business owner should do to turn financial pressure into growth opportunities.

What is causing inflation?

Inflation is a decline in the purchasing power of currency. Like all macroeconomic phenomena, it is affected by both supply and demand shocks. In 2021, US economy is experiencing inflationary pressures due to:

- Vaccine rollouts re-opening the economy and unleashing pent-up demand

- Supplier shortages due to months of Covid-19 lockdowns and related constraints

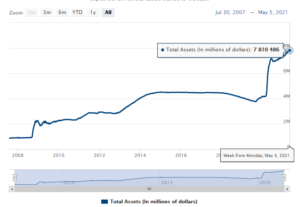

- Federal reserve asset purchasing actions more than doubling the money supply

- Three rounds of federal stimulus payments issuing unprecedented amounts of cash to citizens and businesses

These actions combine to make consumers and investors hungry to spend cash, but without as many goods and services to spend it on. The result is a bidding-war that raises prices starting with

basic goods like steel or oil, and trickling all the way through the economy to things like cars, labor, and chicken nugget dipping sauce.

How inflation impacts small businesses.

While you may be feeling inflation pressures already, it is possible inflation has not yet impacted your small business. Inflation ripples through the economy in different ways and at different times, impacting each business in unique ways.

The immediate impacts of inflation are supply shortages that prevent finished goods from being completed. Consider, for example, how Ford has thousands of nearly finished but still unsellable F150 pickups waiting for computer chips to come in. Manufacturers large and small can have millions tied up in inventory-in-process while awaiting for precious parts to come in. Those who embraced the industry best-practice of Just In Time Manufacturing (JIT) are especially vulnerable today to shortages.

Immediate shortages are typically addressed by bidding higher prices, expediting shipments, and hiring extra workers or paying overtime. This all puts pressure on the costs of a small business, many of whom are unable to pass these extra costs onto their customers due to contracts or competition. That means the extra costs come out of the bottom line, often increasing already existing losses from Covid-19.

Even if your business is not experiencing raw material shortages, you may soon hear your workers demanding higher pay. That’s because the company down the road from your business is offering higher and higher wages to clear out their backlog and keep up with strong demand. Or, if you have lower-wage workers you may find them priced out of your geography as housing prices rise. We see this happening every day in Denver, where CFOshare is located. With an average home price of over $500,000, only professionals can afford to own a home in Denver, driving blue collar workers to other states like Texas.

How to manage inflation in your small business.

Here’s the steps I am recommending every CFO and CEO take to proactively manage inflation in their business in 2021:

1. Strengthen your pricing power.

Every business affected by inflation will be tasked with passing on the price increase to their customers. Even if you are not eventually impacted by inflation, strengthening your pricing power improves your competitive market position. Here’s how we recommend increasing your pricing power:

- Identify what differentiates you from the competition and lean into that product, service, and marketing message.

- Improve the uniqueness of your offering through enhancements, bundling, de-bundling, or branding.

- Target less price sensitive customers in your selling and marketing strategies.

- Shorten your contract lengths or add variable pricing mechanisms, such as commodity fees.

- Invest in your customer experience through more staffing, better training, or better selling processes.

- Vertically integrate your offerings to make yourself a one-stop shop.

- Offer complimentary services, subscriptions, or warranties for your products.

2. Evaluate your supply chain risk.

Supply chain is a complex profession that manufacturers cannot afford to ignore. There are entire books written about managing supply chain risk, but some key vulnerabilities to look for during inflation include:

- Single-supplier dependencies

- One commodity representing over 10% of your costed COGS

- Long lead-time suppliers (e.g. overseas suppliers)

- Bulky, heavy, perishable, or hazardous materials that are difficult or expensive to store.

- Materials you run through a JIT supply chain

Consider taking the following actions to mitigate high-risk supplies:

- Establish alternate supply chains (not just alternate suppliers)

- Establish an expedite supply strategy, such as a domestic alternative to a foreign supplier.

- Consider stockpiling critical supplies with low holding costs

- Review safety stock levels at all levels of JIT supply chains

- Engage in commodity hedging, where appropriate

3. Evaluate your labor market vulnerability.

The impact of inflation on labor markets is a bit unpredictable. While we cannot foresee the exact professions and skillsets that will be impacted, we can reasonably expect the following labor markets to feel some effect of inflation:

- High-demand professions like software engineering

- Low-wage and minimum wage jobs

- 1099 contract laborers, who typically can reprice their wages faster than W2 workers

If your business is highly dependent upon the above professions, develop a human resources strategy to attract and retain talent. This should be done through market-rate pay raises, but also through non-monetary compensation such as career development and employee benefits. If your employees hate their job and only show up for their big paycheck, your business is much more vulnerable to inflationary pressures than one where employee satisfaction is derived from intangible benefits like a sense of community and purpose.

4. Forecast what-if inflation scenarios.

Use your financial forecast to run “what-if” scenarios to test the potential impact of inflation, such as:

- Wages increases of 25-50%

- Raw material prices doubling

- Supply chain disruptions causing 25% or greater revenue delays and inventory build-ups

Anytime you are forecasting what-if scenarios, you need to answer the following tactical questions:

- Will I have enough cash in all scenarios?

- What evasive maneuvers will I take in each scenario?

- Can I manage risk now with preventative measures?

- What metrics will I watch as leading indicators that one of these scenarios is occurring?

5. Take out a loan.

Now is a great time to borrow money! With interest rates being low and inflation potential high, you will likely be paying back the loan with cheaper money than you borrowed. Just be sure you have a place to invest your loan proceeds – good investment opportunities during inflationary periods include:

- Marketing that strengthens and differentiates your brand (to build pricing power)

- Real estate and machinery

- Rare or bulk-discount inventory

- Other businesses such as competitors, suppliers, or customers

Preparing your small business for inflation.

No matter what industry you are in, you need to meet regularly with your finance team to talk about business financial strategies. If you do not have a strong financial team or you would like an evaluation of your business’ financial risks, we are happy to help. Contact us to schedule your free consultation.