It is a new year and new set of small business taxes. This year will be particularly complex as provisions from the CARES act unwind and the sales tax landscape continues its tortuous evolution. Although nobody knows exactly how regulators may change the tax landscape, we know enough at CFOshare to advise our clients on some major things to be aware of when planning business taxes in 2021.

Sales tax risk is on the rise for small businesses

The fallout of South Dakota v. Wayfair continues to be a major issue and, thanks to state budget shortfalls, sales tax enforcement is expected to accelerate in 2021. This is a big risk for small e-commerce businesses, many of whom are out of compliance and do not even realize it. The good news is the software industry is providing more and more solutions to bring companies into compliance. If you are selling products (or sometimes even services) in other states, be proactive to avoid hundreds of thousands of dollars in tax penalties: talk to your accountants to see if you need to do a nexus study.

Take advantage of the Employee Retention Tax Credit

While most businesses were obsessed with the PPP last year, a few opted for the smaller Employee Retention Credit program (ERC.) Businesses could only participate in one of the two programs, and in most instances the PPP was more money faster. However, the Consolidated Appropriations Act (best known for creating PPP round 2) changed the ERC rules, allowing participants to do both ERC and PPP.

The program gives employers up to $7,000 per employee per quarter that they were shut down or experienced “significant decline in gross receipts” aka loss in revenue. In general, if you were shut down by the CDC, DHS, or OSHA regulations; or if your revenue was down 20% year-over-year, your business qualifies (be sure you understand the Internal Revenue Service’s rules for “gross receipts” accounting.) Talk to your payroll provider, accountant, or check out the IRS guidance on how to apply for this tax credit. Or contact our accountants to see if your business qualifies.

Plan for repayment of deferred social security taxes

The CARES act allowed employers to defer social security employment taxes until December 2020. Now that deadline is pushed out to December 2021, giving businesses another 12 months of deferred liability (aka free cash). Do not get caught by surprise – that money belongs to the government, and you should plan to pay 50% back in December 2021 and 50% in December 2022.

If you elected to defer payroll taxes (you likely did this through your payroll software) make sure you have accounted for that tax liability before you file your 2020 income taxes, or you may end up paying too much. Also be sure your forecast includes a 50% lump-sum repayment in December of this year. This repayment usually must occur outside of your payroll software – set an alarm so you do not forget!

Potentially big refunds on April 15th

Did you lose money in 2020? You are not alone, and you might be able to get a big payday from the government based on losses filed on your tax returns. This year the CARES act is allowing Net Operating Loss (NOL) carryback. If you had any taxable income from 2013 to 2019, you can apply 2018, 2019, or 2020’s losses against those past profits to get an tax refund. That means your business will get a refund check from the IRS when you file your business tax return. Work with your CPA to apply your NOL’s properly and get the appropriate refund.

Business income tax rates for 2021

With Democrats in control of both chambers and the White House, there is a risk the government will increase corporate and individual tax rates. Depending on your business nexus, you may be facing such headwinds at both the federal and state level. Keeping in mind change is always possible, here’s the current status of small business income taxes.

Federal income taxes

Federal corporate income tax rates remain at 21%. For small businesses that do not pay dividends, this rate is low enough to make c-corp business structure cheaper and easier than being an s-corp (in spite of double taxation.) This is especially true for companies looking to qualify for section 1202 capital gains exclusion upon exit (our favorite way to avoid paying millions to the IRS.) But with recent announcements from the White House, rates may be increasing to 28%. Check out our article specifically discussing income tax rate changes.

Pass-through businesses like sole proprietors, partnerships, and s-corps are subject to the same tax brackets as last year with a maximum income tax rate of 37%. Since your small business tax rates are mixed in with your personal tax situation, be sure to include your personal CPA on any business income tax planning discussions. The qualified business income deduction may be going away, so keep an eye on tax reform legislation.

Congress also passed some changes to business tax deductions at the end of 2020, such as allowing business meals expenses to be fully deductible. To take advantage of all these deductions, make sure your accounting is accurate and include all expenses before submitting financials to your CPA.

State income taxes

Twenty-six states changed income tax laws in significant ways, so you will need to investigate what applies directly to you. The following corporate tax rate changes are of particular note for small business owners:

- Arkansas reduced corporate income tax rate from 6.5% to 6.2%

- Iowa reduced corporate tax rate from 12% to 9.8%

Changes to individual tax rate policies are more complex and include a web of deductions and bracket classifications.

- Changes that are effective tax increases:

- Arizona

- New Mexico

- Changes that are effective tax decreases:

- Arkansas

- Connecticut

- Iowa

- Massachusetts

- Tennessee

Keep in mind you may be required to pay state taxes simply because you do business there, regardless of where you are incorporated. That includes having an employee working in a different state than that in which you are incorporated – a common event following the transition to work from home. Sourcing significant amounts of revenue from different states also has major tax implications, so work with your CPA to understand nexus rules.

Different states also have different types of business taxes. Work with a CPA located in that state or one familiar with multi-state returns to plan the correct business tax rates for 2021.

Local taxes

Do not forget about your local taxes! Many municipalities are changing their taxes and fees to reflect the challenges of Covid-19. Keep an eye on changes in sales and use tax, employment taxes, and licensing fees. Contact your local taxing body or business association to see if local tax rates are changing.

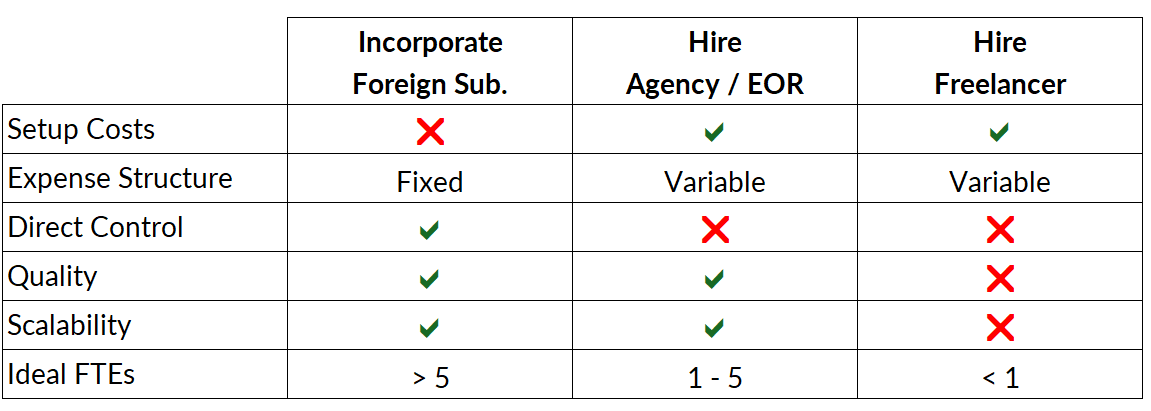

Navigating small business tax rates

If you feel lost or overwhelmed by the complexity of small business tax requirements, you are not alone. Best practice is to hire a professional accountant to ensure compliance and plan your tax payments. Contact us to meet with a CFOshare consultant, take advantage of tax credit programs, and get your business compliant.