Over the past ten years, the role of a fractional CFO has changed the small business landscape. Hiring a full-time Chief Financial Officer (CFO) is seldom viable for small businesses and startups. Enter the fractional CFO—a part-time financial expert who can provide top-tier financial oversight without the full-time cost.

Whether you are an entrepreneur hiring a fractional CFO or a finance professional considering a change to the fractional profession, understanding fractional CFO salary trends can help you make an informed decision.

What is a Fractional CFO?

A fractional CFO is a part-time CFO for small companies. Rather than working full-time for one business, a fractional CFO works part-time for several businesses offering specialized financial services that can include:

- budgeting

- forecasting

- financial reporting

- unit economic analysis

- capital planning

- turnaround services

- strategic planning

Fractional CFOs are a cost-effective way for small businesses to access finance professionals without the commitment of a full-time employee.

Factors Influencing Fractional CFO Salary

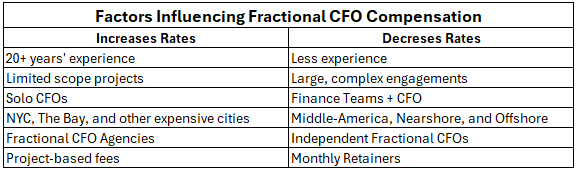

Experience and Expertise

Fractional CFOs have a variety of backgrounds – from over-glorified accountants to public company veterans and everything in between. CFO compensation increases with extensive experience in your industry, proven strategic planning skills, and a track record of driving financial performance.

Team and Engagement

Some fractional CFOs work alone, while others work with a team of analysts, accountants, and bookkeepers. A team approach offers a lower average bill rate and a broader skillset. On the other hand, a team approach can be overkill for a very small business that only needs a few hours of services per month.

Scope of Work

The complexity and scope of the tasks assigned to the fractional CFO also play a crucial role in determining their pay. Mergers and acquisitions, strategic advisory, turnaround projects, and involvement in high-stakes financial decisions will attract higher compensation compared to more routine financial management tasks.

Geographic Location

Geographic location can influence the salary trends for fractional CFOs. New York and California CFOs are more expensive than CFOs in middle America.

Duration and Frequency of Engagement

The length and frequency of the engagement also affect the compensation. Long-term contracts often include rate discounts, while on-demand and urgent engagements demand the highest rates.

Average Fractional CFO Salary

Fractional CFOs generally earn about $250,000 annually – the same pay as a full-time CFO. However, due to varying workloads, a Fractional CFO could earn substantially more or less than a full-time CFO. Many fractional CFOs choose to work fewer than 40 hours per week to enjoy more personal time.

Fractional CFOs can work freelance or be an employee of a fractional CFO agency.

Freelance Fractional CFOs

Independent fractional CFOs work as 1099 contractors, often self-marketing their services or paying referral fees from lead-sourcing agencies. These fractional CFOs have great autonomy in their work, setting their own schedules and quality standards. However, project volume is often inconsistent, creating unreliable income streams.

Agency Fractional CFOs

Many fractional CFOs choose to work as full-time W2 employees of agencies like CFOshare. This employment relationship creates steady work and income, removes sales and administrative burdens, and supports the CFO with a team of accountants and analysts.

Average Fractional CFO Fees

The clients of fractional CFOs pay anywhere from 10% to 50% of that salary, depending on the number of clients the CFO serves. Service fees can take the form of three payment structures: hourly rates, monthly retainers, and project-based fees.

Hourly Rates

Fractional CFOs most commonly charge hourly rates ranging from $150 to $500 per hour. This wide range reflects the variability in expertise, location, and project demands.

Monthly Retainers

For ongoing engagements, fractional CFOs may work on a retainer basis. Monthly retainers can range from $3,000 to $15,000, depending on the scope of work and the frequency of engagement.

Project-Based Fees

Fractional CFOs might charge a flat fee for specific projects, such as fundraising, mergers and acquisitions, or financial restructuring. These project-based fees can range from $10,000 to $50,000 or more, depending on the project’s complexity and duration.

Conclusion

Understanding the salary trends and benefits of hiring a fractional CFO can empower small business owners and startup founders to make informed decisions about their financial management strategies. By leveraging the expertise of a fractional CFO, businesses can navigate financial complexities, optimize performance, and achieve sustainable growth.

Whether you need strategic financial planning, budgeting, or financial restructuring, a fractional CFO can provide the expertise you need without the burden of a full-time salary. Investing in a fractional CFO can be a game-changer, driving your business toward greater financial stability and success.

This article was written by a CFOshare employee with assistance from generative AI for rhetoric, grammar, and editing. The ideas presented combine the author’s expertise, original ideas, and industry best practices.