Confident Decisions Start with

Expert Financial Guidance

Confident Decisions

Start with

Expert Financial Guidance

From startup to scale, CFO Share provides a consultative partnership that delivers the insights you need to understand your business, industry, and market.

Excellent communication

What use is an accountant who never responds to your emails? Our 24-hour responsiveness promise guarantees you will not be left waiting.

Excellent communication

What use is an accountant who never responds to your emails? Our 24-hour responsiveness promise guarantees you will not be left waiting.

Excellent communication

What use is an accountant who never responds to your emails? Our 24-hour responsiveness promise guarantees you will not be left waiting.

Excellent communication

What use is an accountant who never responds to your emails? Our 24-hour responsiveness promise guarantees you will not be left waiting.

Flexibility

No long-term contracts; we earn your business every month.

Flexibility

No long-term contracts; we earn your business every month.

Flexibility

No long-term contracts; we earn your business every month.

Flexibility

No long-term contracts; we earn your business every month.

Radical transparency

We earn your trust by giving you clear insight into the good and bad of your business, especially if it means owning a mistake we made.

Radical transparency

We earn your trust by giving you clear insight into the good and bad of your business, especially if it means owning a mistake we made.

Radical transparency

We earn your trust by giving you clear insight into the good and bad of your business, especially if it means owning a mistake we made.

Radical transparency

We earn your trust by giving you clear insight into the good and bad of your business, especially if it means owning a mistake we made.

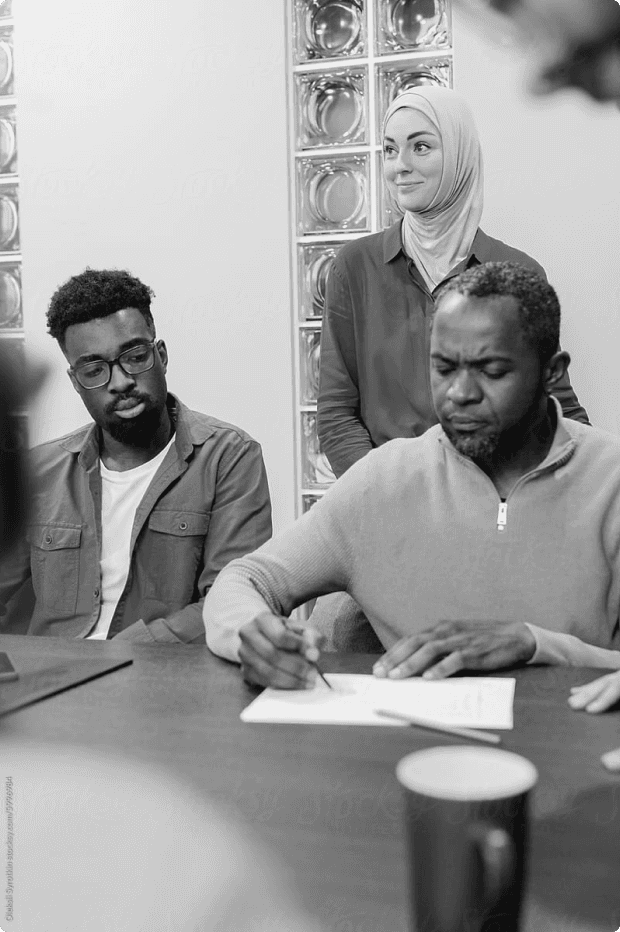

Team approach

You get a team of financial specialists for less than the cost of one FTE

Team approach

You get a team of financial specialists for less than the cost of one FTE

Team approach

You get a team of financial specialists for less than the cost of one FTE

Team approach

You get a team of financial specialists for less than the cost of one FTE

Client testimonials

Joe Selvik

Co-Founder, FixturFab

Tatinana Finkelsteyn

CEO, Zlinq

Jessica Crothers

COO, Good Buy Gear

Nick Otis

Managing Member, Globeville Building and Land

Joe Selvik

Co-Founder, FixturFab

Tatinana Finkelsteyn

CEO, Zlinq

Jessica Crothers

COO, Good Buy Gear

Nick Otis

Managing Member, Globeville Building and Land

Joe Selvik

Co-Founder, FixturFab

Tatinana Finkelsteyn

CEO, Zlinq

Jessica Crothers

COO, Good Buy Gear

Nick Otis

Managing Member, Globeville Building and Land

Joe Selvik

Co-Founder, FixturFab

Tatinana Finkelsteyn

CEO, Zlinq

Jessica Crothers

COO, Good Buy Gear

Nick Otis

Managing Member, Globeville Building and Land

Joe Selvik

Co-Founder, FixturFab

Tatinana Finkelsteyn

CEO, Zlinq

Jessica Crothers

COO, Good Buy Gear

Nick Otis

Managing Member, Globeville Building and Land

Joe Selvik

Co-Founder, FixturFab

Tatinana Finkelsteyn

CEO, Zlinq

Jessica Crothers

COO, Good Buy Gear

Nick Otis

Managing Member, Globeville Building and Land

Numbers That Speak for Themselves

Revenue under management and counting

Explore practical insights designed to transform your financial strategies and unlock new opportunities.

Seamlessly integrated finance to unlock growth.

Want to learn more? Schedule a call to meet with our team.