The circus of wall street seems a far-ways away from most small business concerns – but are you aware of how this stewing financial crisis may affect your business? As a fractional CFO, my job is to manage business risks and advise CEO’s of potential problems. To me, the chaos on wall street driven by WSB is the most dangerous risk since Covid-19. Here’s why.

The Rise of Retail Bros and Wall Street Bets

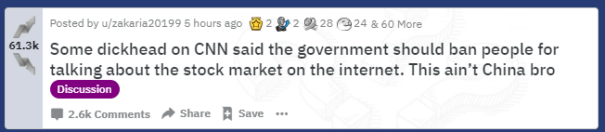

Thanks to Covid-19 and a global pause in sports betting, 2020 saw a massive surge in what’s called retail investors – individuals, not institutions, trading the stock market. These investors are less disciplined by fundamentals like revenue growth and profitability, more intuitive and emotional. The old stereotype of a retail investor was an upper-middle class American man who admires Warren Buffet. Today’s stereotype is a mid-20’s bro wearing a backwards baseball cap trading on Robinhood between sets at the gym. Just read a few of their messages and you’ll understand why they are called Retail Bros.

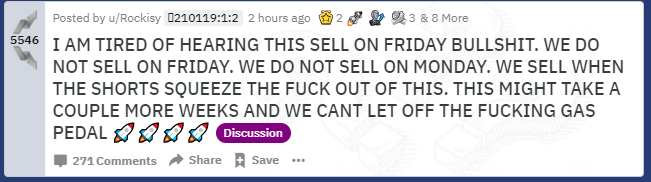

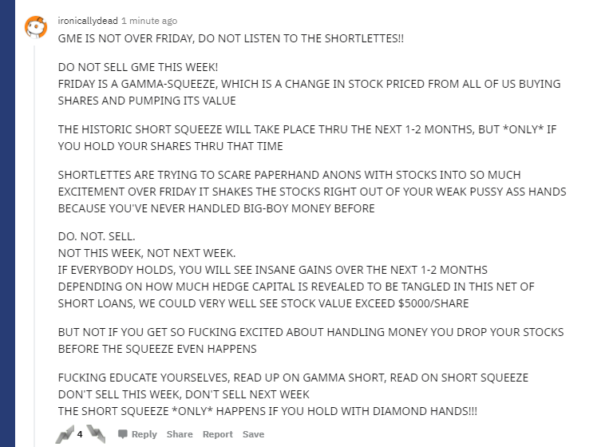

The investment thesis of the bros is simple: if everyone buys the stock all at once, the price will shoot through the roof. They coordinate buying actions on the sub-reddit Wall Street Bets, with all the eloquence and sophistication of a flash-mob.

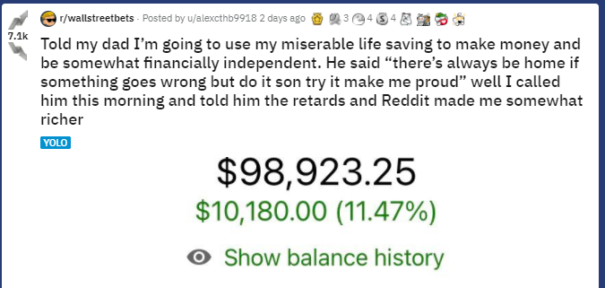

My personal favorite investment analysis is when they bet their life savings on a YOLO investment.

Why WSB Has Been Successful with Gamestop (GME)

Institutional investors are not prepared to deal with a flash-mob of bros on the trading floor. In fact, the highly automated algorithmic market makers have found their formulas turned against them. Here’s how:

- WSB traders buy call options which are riskier than buying shares of stock but magnify their returns.

- Call options are sold by market-makers such as Citadel Securities or Susquehanna

- Market makers offset the risk of call options by purchasing underlying shares. This drives up the price of the shares and is called a Gamma Squeeze.

- Short interest of the stock gets margin called, forcing them to buy shares to cover, further inflating the price. This is called a Short Squeeze.

This has been a remarkably successful strategy for WSB. One user claims to have made over $11 million dollars. The price of GME stock speaks for itself – as of Wednesday it had outperformed nearly every stock year-to-date at 1900%+ gains. The strategies themselves are legitimate, but the power of the strategy comes from the WSB group’s coordination which gives them incredible power to influence the markets. So much power, in fact, it’s borderline illegal. Depending on who you ask, the WSB crowd could be colluding, front-running, committing securities violations, or committing wire fraud. For example, if Goldman Sachs called up Citadel said “Buy GME stock until the price hits $1000!” they would be fined by the SEC for market manipulation. WSB posters routinely coordinate investment timing like this, but have not been subject to regulatory punishment yet.

Who is losing money due to WSB?

Just remember: for every winner on Wall Street, there is a loser. So who is losing? The financial markets are complex, and nobody has a complete picture about what’s happening yet. But here’s the losers we know:

Hedge Fund Short Squeeze

WSB has intentionally targeted companies who publicly announce their short position on stocks, such as Andrew Left at Citron Research. By creating a short squeeze, short-sellers like Citron have been forced to cover or exit positions altogether, consuming their capital.

Market Maker Gamma Squeeze

The market makers that sold the call options are finding themselves in situations their formulas were not designed to handle. As a result of the gamma squeeze, they may find themselves holding highly over-valued shares of stock or paying cash to de-risk their portfolio.

Retail Bros

Given the general recklessness with which they invest, there are likely some WSB members who have lost money in the game. Those members are not as forthcoming with their results on Redditt, but probabilistically there is must be a significant amount. Especially…

The guy left holding the bag.

Everyone including the WSB retail bros knows this party will not last, and the last person left holding GME stock will be the biggest loser. That’s the nature of an asset bubble – the early investors profit big, and the late investors incur the losses. The question is: when do you get out? On the one hand, FOMO makes investors want to ride out future price increases; on the other, they’re playing a game of chicken with everyone else on WSB. As a result, a lot of the posts on WSB revolve around ridiculing people who sell early to harvest their profits.

The Broader Financial Markets

All this uncertainty is causing investors to rein in capital to either lower risk or due to contractual obligations (such as the case of the short sellers and market makers.) This is often done by selling equities, thus spreading the losses to the broader market and driving down the value of all investments. This is the same effect we saw in 2008 when the collapse of the mortgage security market affected all financial markets.

The Threat of Retail Bros to the Financial System

So what if a handful of guys is getting the best out of hedge funds? Why should a small business owner care?

You and everyone you know should care if WSB precipitates a financial crisis. A financial crisis is a mega-recession. Most recessions are mild because they only affect one industry – think 2001 dot-com bust, which mainly hit the tech industry. A financial crisis is when a bubble bursts in the financial sector, which is tied to EVERY industry. This is what happened in 2008 with housing derivatives and 1929 with margin equities. When a financial crisis hits, capital freezes up and no business is left untouched. Public equities are not only a Wall Street company concern – they are an important pricing mechanism that influences private investment (including venture capital and angel investment), bank lending, foreign exchange, business acquisition funding, and many other markets small businesses rely on.

Could the WSB bros create a financial crisis? A Bro-pocolypse? Maybe. I think the probability is low, but in the slim chance that happens, the impact would be broad and deep.

If the market makers are unable to adapt to the WSB coordinated market manipulation, a liquidity crisis could quick precipitate resulting in widespread freeze of capital. The last capital freeze occurred at the height of the 2008 crisis. Credit becomes scarce and the damage spares no one; however, a capital freeze especially deadly for small businesses who have trouble accessing capital even in the good times.

How Small Business Owners Should Prepare for the Retail Bro-pocolypse

As a CFO, my job is to allocate business resources to manage risk and returns for stakeholders. Right now there is a significant risk in the capital markets, so I’m willing to sacrifice some returns in order to de-risk the business. If you want to de-risk your small business, here’s some precautionary steps to take:

Update Your Forecast.

Run a business forecast to understand how dependent your company is on debt or equity capital. If you have lots of cash even in a downside scenario, you will likely be ok. But if your business requires an equity investment round in the next 12 months or you rely on cyclical debt to finance working capital, you are exposed in a financial crisis.

Save Capital.

The next 2 months is not a good time to invest heavily in growth. Trim your plans to save capital. That might mean delaying the purchase of new machinery, reducing advertising spend, or delaying hiring new headcount.

Secure Debt.

In a financial crisis, nobody is willing to issue loans. Make sure you setup a debt facility setup now, such as a business line of credit or a HELOC. These facilities exist for a year or more and renew periodically, so you’ll be guaranteed cash available if a crisis ensues.

Secure Equity.

If you were planning to raise equity investment in March or April, you should consider accelerating that timeline in. Closing a round even a day or two before a financial crisis ensues could be the difference between success and failure.

Plan With Your Advisors.

Take the time to discuss contingency plans with your CFO or financial advisor. In particular, try to understand your capital position and potential vulnerabilities. By discussing options in advance, you will know how to react when a crisis begins.

Keep Your Ear to the Ground.

The signs of the 2008 financial crisis began in 2007, but most didn’t realize what was happening until almost 10 months later. Keep reading the articles about WSB and GME, keep your eye on indicators like the S&P 500 and the yield curve, and keep any eye out for Lehman Brothers’ type of failures on Wall Street.

Remember, nobody successfully navigates a crisis without a good team. At CFOshare, we help clients with business strategy and capital planning to avoid risks and survive crisis. If you’d like a consultation with a fractional CFO, book an appointment or email us. Info@CFOshare.org