Lean | Startup

Lean Finance for a Lean Startup

May 24, 2017

How can we apply “The Lean Startup” principles to a company’s financials?

Eric Ries revolutionized entrepreneurial thinking by applying Toyota Production System Lean Manufacturing to businesses facing extreme uncertainty. If you haven’t read it, stop everything go read the book! This is Startup 101.

As a reminder, The Lean Startup is about validation assumptions as quickly and inexpensively as possible in order to determine whether a strategy should pivot or persevere. The idea is to systematically eliminate risk and uncertainty with scarce resources (i.e. cash and time.)

Whether he realized it or not, Ries’ system is one of managerial finance.

Why Traditional Managerial Finance Fails Startups

Managerial finance is a study of numbers to drive improved business results. It is a process of drawing meaning from numbers and influencing decisions. This is the difference between a bean counter and a good CFO. Most CFO’s do this through trend analysis, variance vs budget, etc.

Traditional managerial finance fail to help a startup. Startup challenges include:

No historical financials

Poor industry comparisons

Negative cash flows

Non-traditional metrics

This reality violates most assumptions we learn in finance school. To overcome this, Ries developed “Innovation Accounting,” a method for measuring progress in a rapidly changing enterprise. It serves managers well, though, ironically, not accountants.

How to we marry these two worlds in a sensible way? There is one tool that works.

Real Option Analysis for Lean Finance

CEOs and investors can rest easy in this highly uncertain world using real options analysis. CFOs use this science/art to quantify the value of validating assumptions into a simple map anyone can understand. As an example, consider an airline ticket for your next vacation. It currently costs $500, but you think the price may drop $50. Then again, you’ve been burned by the opposite as well – the price goes up $50.

What if you could lock in an option to buy the plane ticket at $500 for just $5 now? If the price goes up, your total cost is just $505. If the price goes down, you can write off the $5 and buy a cheaper ticket at $455 total cost. Assuming a 50/50 chance of either outcome, your expected spend is ($455+505)/2= $480, compared to $500 without the option (($550 + $450) /2)

How would this apply to a lean startup?

Suppose your new app isn’t engaging the customer as much as you hoped. Your adviser suggests adding a social media feature. Engineering recommends debugging the code to reduce errors. And UX says the design is poor and repels users. Three paths – what do you do?

Lean Startup says you iteratively and scientifically test each change. Which do you choose first? Lean Finance says let’s do a quick ROI analysis to choose a smart investment. But how do you calculate an ROI without cash flows? Using real options analysis!

ROI Using Real Options

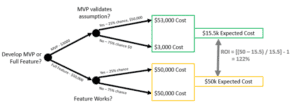

Let’s start by considering the social media feature. You sit down with marketing and engineering and estimate a build out of the entire feature will cost $50,000. However, a minimum viable product (MVP) version can be developed and tested for $3,000 to validate the hypothesis that a social media feature will increase engagement. Based on your marketing team’s reputation, you expect a 25% chance they are correct.

We can summarize this data with a decision-tree. In doing so, we have turned it into a “Network Problem” which we solve by starting at the end and moving backwards:

Real option analysis calculates the ROI of a startup’s MVP

Real option analysis calculates the ROI of a startup’s MVPBased on reducing the risk of uncertainty, we can calculate the ROI of developing an MVP: 122%

Repeating the exercise for each option (UX improvements, debugging code, and social media feature,) your management team can rationally decide the best use of time and cash. That is the power of Lean Finance using real options analysis.

Data-Driven Decisions = Happy Employees

How would your startup have handled the situation? Have a meeting to argue about what we think is best? Seek advice from friends? Maybe YOU would make the decision and force everyone to follow along. How happy will your engineers be to work on a UX improvement they see no value in? Can you afford to lose a good engineer simply because he or she doesnt believe in your decision?

A better approach is to gather decision makers in one room and build out the real option analysis. With the costs and ROI’s clearly mapped out, the team can make data-driven decisions unclouded by emotion. A smarter, easier path to success with healthy employee engagement.

Clarity through Finance

A good CFO saves time and cash by empowering employees to make better decisions, contrary to the misconception that a CFO is a glorified accountant, and easily replaced by QuickBooks. Founders with the wisdom to hire a real CFO have an indisputable competitive advantage, and will out-compete amateur financial leadership every time.

Related Articles

Ready to Elevate Your Finances?

Need more specific advice? Schedule a consultation