Small Business

Financial Planning for a Recession

September 19, 2019

As we learned in 2008, recessions can come on swiftly and cause major crises for all businesses, big and small. In today’s economy, it is essential to practice intentional recession planning as a small business. By mapping out your plan in advance of a recession, you may find that when a recession hits, you not only survive, but thrive.

Make a Plan: Preparing for a Recession

Simply having a plan in place sets you head and shoulders above the competition. When the reality of an economic downturn hits, the act of decision making can become paralyzing, and second guessing can slow down important steps.

When creating a plan, work through a variety of scenarios, from the best to the worst. You should already be familiar with your key business drivers through a forecast sensitivity analysis – use this information to plan what to do in the instance of a negative shock, so that your decision making can continue to be swift and precise. It is easier to make these decisions before you are in this situation than when you are in the thick of it.

Anticipate Cash Flows

Cash is king in a recession, and you need to know that your cash flows will not be interrupted. Keeping cash flowing out of the business is easy, of course, but make sure that you have plans in place to continue supplying the cash flow you need to maintain operations.

Prepare Financing Options

Before a recession appears, discuss your recession plan with shareholders. Let them know that their help may be needed during this downturn. This will ensure they are prepared and willing to help the business ride out the storm.

Also prepare your debt vehicles. By ensuring you have plenty of access to lines of credit or equipment financing, you can ensure you don’t end up with a cash shortage that stops your business short.

Review Accounts Payable and Receivable

Another important way to manage cash flows during a recession is by thoroughly reviewing your accounts payable and receivable and getting things back on track. If you find you have customers who are majorly delinquent, this may be the time to end those relationships if they cannot be rectified. Tighten up accounts receivable turnaround times to the extent that you can. It is easiest to tighten up AR in advance of a recession, when customers have excess cash.

Diversify your Customers

Adding to your customer base is always important, of course, but it is particularly important before a recession, given losses you may experience once the recession hits. Many small businesses have one client who, if lost, would cause the company to crumble. It is important to do what you can to make sure that is not the case for you. And if you do have a couple of key clients, really focus your efforts on them to make sure they stay happy and on board with your product or service.

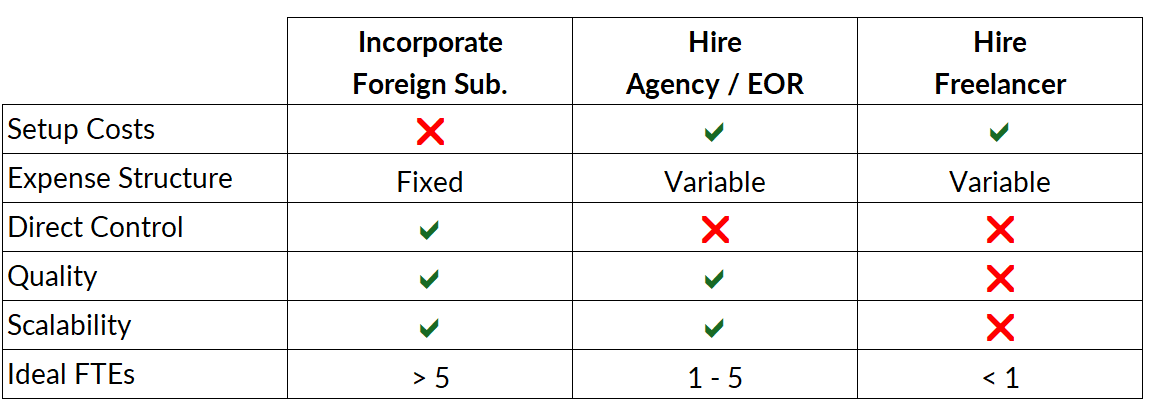

Expand Internationally

This is not possible for all small businesses, but if you can, it is good to establish a presence in other countries. This speaks to diversification, as your clients and sales in the United States may take an inevitable downturn due to the economy, but the state of other countries’ economies can serve to balance this out if you are not solely dependent upon U.S. clients. The plausibility of this will depend on what type of business you do, of course, but if international sales are possible for you, this is a good way to dampen the recession’s impact on your total sales figures.

Indicators of Recession

There are a variety of indicators of a looming recession, and while nothing is 100% certain, some are stronger indicators than others. These indicators range from wide in scope, looking at the entire economy of the United States, to very small, examining patterns in your own business or industry before previous recessions.

Major Economic Indicators

One of the most reliable indicators of an economic recession is known as the yield curve. This is a curve based on the yields on all Treasury maturities. Generally, bond with longer maturities offer higher yields than those with shorter maturities. This is because of the increased risk of owning bonds with longer maturities, and makes logical sense.

When this upward-sloping curve inverts, it is a good indicator of an upcoming recession. In fact, in the last 50 years, the yield curve has inverted before every recession, and has only offered one false indication.

Global trade wars and raw material shortages can also be a larger-scale indicator of an upcoming recession.

Smaller-Scale Indicators

Another thing you can look at, is any pattern your business experienced before previous recessions, particularly in 2008. Oftentimes, small businesses will notice sluggish growth and fewer inquiries or requests for proposals. Look for patterns in your business and take note of them if and when they occur, particularly if they occur in conjunction with more broad economic indicators.

What to Do when a Recession Hits

You need to act quickly to maintain your customer base and make strategic decisions, and having previously agreed upon a set of steps to take when a recession hits will majorly expedite this process.

Labor and Layoffs

One of the hardest things in a recession is having to let go of members of your staff. However, it is a reality that you will have to face. Analyze various positions at your company and lay off those employees that are not providing adequate benefit to merit their salary.

Be aggressive with your first round – your goal should be to avoid a second round of layoffs. Lay off nonessential personnel and then do everything you can to keep your business afloat in other ways. This first round of layoffs is often unavoidable.

Inventory

One relatively pain-free step you can take early on is to review your vendors and make sure you’re not missing cost-cutting opportunities. You may have had the same vendors for a long time and not thought to negotiate lower prices or look around and see whether lower costs for similar products are being offered elsewhere. This can be hard if you have a loyalty to your vendors, but remember that if you don’t survive the recession, you won’t be anyone’s customer, so try not to let this get too personal. If you are considering switching vendors, always discuss the reason with your current vendor, and perhaps they can match the price or service of the new vendor.

During a recession, you will also need to liquidate inventory and renegotiate the terms with vendors if you are receiving more than you can sell. The cost of keeping goods on hand is often high enough that letting go of inventory for less than you would like may be the best option. One solution is to create a vendor stocking agreement so they hold your inventory at their own cost.

Accounts Payable

On the flip side of this coin, you will want to see whether you can push out accounts payable. Smaller vendors have less negotiating power and can be more easily pushed out to Net 60 or Net 90. During a recession, larger vendors may be willing to extend terms in exchange for more volume (at their competitor’s expense,) which will leave you with more cash in hand. It is easiest to push out AP during a recession, when vendors are desperate to keep your business.

Manage Expenditures

When planning for a recession, running a tight ship has to be a major part of the equation. This, of course, means cutting costs where you can, and resetting purchasing controls with your staff. Make sure the expectations and business needs are clearly communicated to your employees so they can help you succeed.

Take Advantage of Economic Conditions

Small businesses can take advantage of a recession to gain market share and prepare for the next growth cycle. If you are in a secure cash position and have weathered the initial downturn, it’s time to make bold moves and seize opportunities.

Hire Employees

Good talent is much more available and less expensive during a recession. Fire up your HR team and go after high-end employees such as directors and managers.

Lease Terms

Renegotiate your lease terms during a recession. This is one area where you can benefit from the economic downturn, as your landlord may have some properties sitting vacant and is more likely to be willing to renegotiate the terms of your lease than during better economic times.

Gain and Retain Customers

One mistake many companies make when facing a recession is pulling back on their efforts to gain customers. This is the time to get ahead of your competition in terms of gaining market share. Work to attract competitors’ clients. Ramp up your marketing efforts. If it doesn’t detract from your core competencies, consider expanding your offerings in ways that might draw clients away from your customers and towards you.

Buy a Business

If you are in a financial place to do so, this is also a great time to consider acquiring other businesses in your sector. Financially distressed businesses often sell for less than their book value, so it’s a great way to gain market share and strengthen your position in the face of a recession.

While no one hopes for a recession, the best way to handle one is by planning. Knowing that you have mapped out the best and worst case scenarios, and everything in between, can give you the peace of mind to move forward during tough economic times.

By planning in advance and keeping your shareholders and executive decision-making team in the loop, you will be able to act quickly when necessary, taking steps that will allow you to beat out slower businesses and survive the economic downturn. If you need some help mapping out various recession scenarios for your business, or figuring out how to best position yourself in the face of a looming recession, CFO Share can help. Contact us today to discover how our experts can help you plan for your business’s future.

Related Articles

Ready to Elevate Your Finances?

Need more specific advice? Schedule a consultation