Did you hear Southwest Airlines will end open seating in an effort to boost its profits? This, and other operational changes, mark a departure from its 57-year strategy of operating differently from mainstream carriers—a strategy that forced most of its competitors into bankruptcy.

The end of open seating was a suprise to me. Hearing it, I assumed they must be losing money using an old strategy. I was wrong; they are still profitable.

So why is Southwest abandoning a winning formula? And what can other business executives learn from their example?

Southwest Airline’s Financial Performance

Southwest Airlines is famous for reliable profitability in the mostly unprofitable airline industry. It focused on low-cost/high-volume business that was fairly resistant to cyclical business cycles.

During my years as a Revenue Strategist at United Airlines, I envied Southwest’s consistently high profits—so consistent that it took the COVID-19 pandemic to end a 47-year profitability streak. During that same 47-year period, United went through three bankruptcies (two as Continental and one as United).

Our revenue strategy at United differed: focus on international business travel and maximize profit during boom cycles. For United, the good times were good, but the bad times were terrible. At Southwest, every quarter was pretty decent. In the long run, Southwest’s strategy beat United.

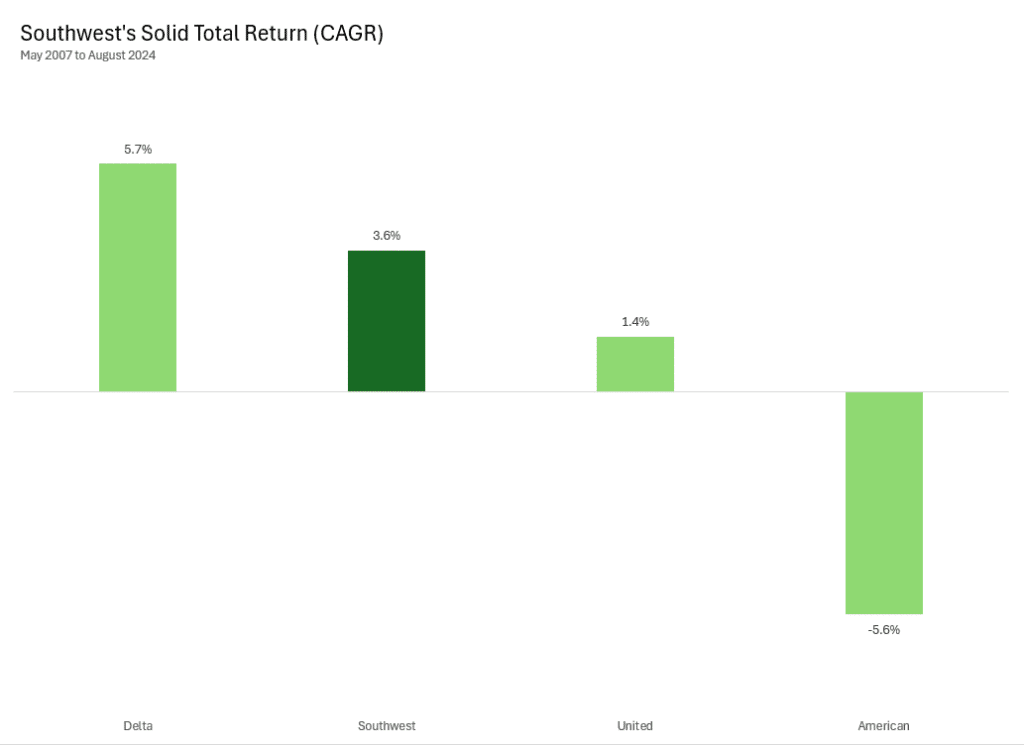

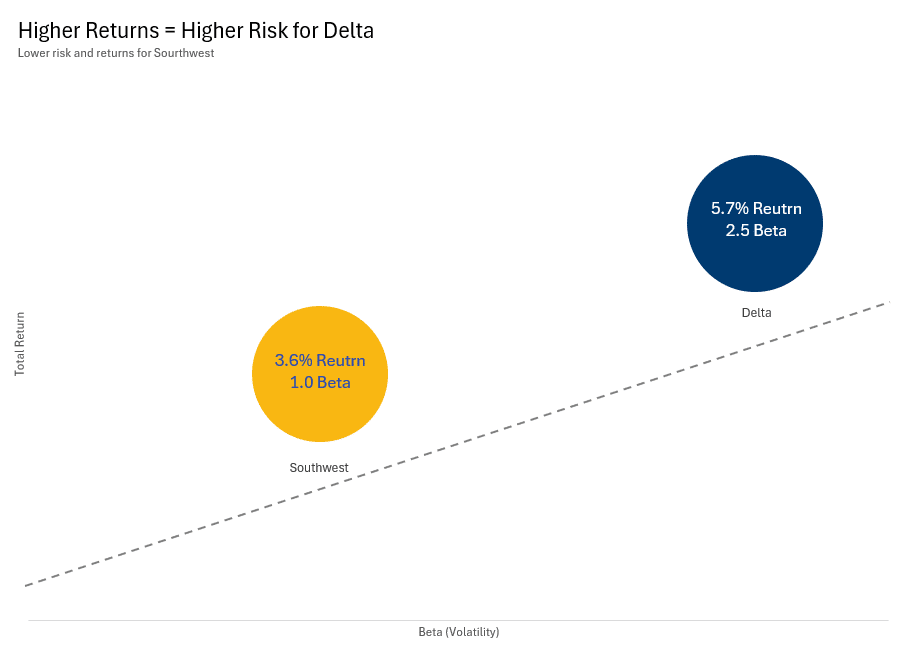

Looking at all major airlines, Southwest is second only to Delta in total return over the past 15 years. Although Delta beat on total return, it took a volatile path to get there, with 6x higher investor risk than Southwest’s stock. In terms of risk-adjusted return, Southwest easily wins.

Why is Southwest abandoning the reliable winning strategy now?

Southwest’s rationale for changing strategies

On June 10th, Elliott Investment Management, which had built up a $2B stake in the company, sent a letter to the board saying, “While Southwest has a proud history, that history is not an argument for supporting poor leadership and sticking with a strategy that no longer succeeds in the modern airline industry.” Elliott demanded they modernize the business model and subtly threatened to oust the CEO if he did not respond.

Elliot was deploying a classic activist investor play. Here’s how it works:

- Buy a controlling stake in an old, boring company.

- Threaten a hostile takeover if they don’t change things up.

- When the CEO announces big changes and the share price jumps, slowly sell off the stock and make money.

Elliott is suggesting Southwest’s financials look more like Delta’s – higher return and higher risk. Is that really the best strategic position? What if Southwest botches the transformation and they end up like American Airlines – lower return AND higher risk?

Economic theory says the activist investor adds value by breaking the lethargy and bringing innovation to the old company. In reality, activist investors are notorious for making short-term gains at the expense of a company’s long-term health. (Although Southwest stock will be in your retirement portfolio for 15+ years, I doubt Elliott will hold their position that long.)

No matter how I look at it—as a traveler, a CFO, or an airline revenue strategist—I cannot help but feel disgusted by the situation.

Small business lessons from Southwest Airlines

Southwest’s plight comes with a clear moral: choose your investors wisely.

As a public company, they cannot stop Elliott from taking a major stake. But you, as an entrepreneur, have the privilege of accepting and rejecting investment offers.

Avoid rushing into a capital agreement. Take your time to shop around for the right investors. Interview them as though they are future employees. Do they align with your values and vision? Do they have the correct risk/reward profile?

You will never find a perfect match in investment partners – they all have ulterior motives – so make sure you understand their gaps:

- For a bank loan: what is their ideal risk profile? What are the hard lines you cannot cross as a borrower?

- For an angel investor: how active do they plan to be? Do you welcome the input or want to stay focused?

- For venture capital: What round do they want to exit? What kind of funding will you be prohibited from taking in the future?

- For private equity: What are their growth targets? How many years are left on their fund?

- For partnerships, Do they understand their “rights” as partners versus yours? Are they prepared to govern, or will they think like employees? Will they settle disputes professionally, or do they have a history of acting petty and childish?

The right capital partners will keep your business growing, manage your risks, and keep your focus square on your goals. The wrong capital partners will derail your plans and take away your agency.